Business reporter, BBC News

Getty Images

Getty ImagesA rise in the cost of household bills has pushed UK inflation to its highest rate in more than a year, according to official data.

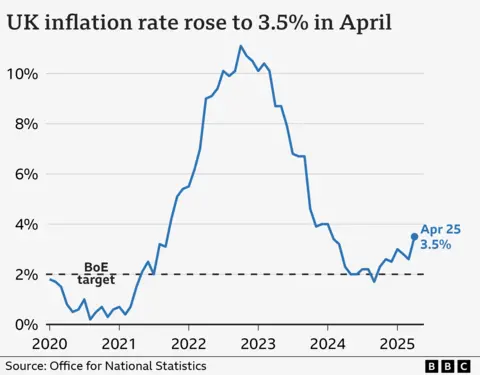

Inflation was 3.5% in April, up from 2.6% in March and higher than economists had expected.

Water, gas and electricity prices all went up on 1 April along with a host of other bills, pushing inflation further above the Bank of England’s target of 2%.

The largest upward contributors to the rise were from “housing and household services, transport, and recreation and culture,” the Office for National Statistics said.

The pace of price rises was forecast to be around 3.3% for April.

The Bank of England has previously said it expects inflation to spike at 3.7% between July and September 2025 before dropping back to its 2% target.

In April, households were hit by sharp rises in energy and water bills, and – to a lesser extent – higher food prices. Firms were also hit by higher costs – a rise in employer National Insurance contributions and a higher minimum wage.

The ONS says prices of water and sewerage rose by 26.1% in April, which it said is the largest rise since at least February 1988.

Rising costs of airfares and food also contributed to the surprise inflation figure.

The timing of Easter is thought to have contributed to the rise in flight costs and package holidays, which economists think will be a one off.

From a consumer point of view, Tom Pugh – an economist at RSM UK – says it’s “obviously pretty bad news”.

“The other thing worth pointing out is we had a very late Easter this year,” Pugh explains.

“That means things like airplane prices were very, very high compared to normal, things like package holidays were much much higher.”

Meanwhile, the cost of services specifically rose 5.4% in the year to April, which economists said was due to changes to National Insurance Contributions for employers and higher minimum wage coming into force.

Services inflation refers to rises in prices for services like eating at a restaurant, getting a haircut, or going to the cinema.

Britain is a services-led economy which means that more of our jobs come from providing a service rather than making a product.

Analysts also pointed to other inflation figures which they said are concerning.

Core inflation which strips out volatile prices such as energy and food – and services inflation – both rose more than expected.

Analysts previously predicted two additional interest rate cuts this year, but the latest inflation data now throws that into doubt, with some thinking there could only be one.

Huw Pill, chief economist and executive director for monetary analysis at the Bank of England, said he feared the Bank was reducing rates too rapidly and that the momentum behind falling inflation was “stuttering”.

Joshua Mahony, chief market analyst at Scope Markets, told the BBC that the markets are worried.

“We had been pricing in an additional two interest rate cuts at the back end of this year, that has now shifted to just one,” he said.

Grant Fitzner, acting director general of the ONS, said: “Significant increases in household bills caused inflation to climb steeply.

“Gas and electricity bills rose [in April] compared with sharp falls at the same time as last year due to changes to the Ofgem energy price cap.”

Chancellor Rachel Reeves said she was “disappointed” with the figures and cited April’s minimum wage rises and the decision to freeze fuel duty as helping pepole with the cost of living pressure.

Mel Stride, shadow chancellor, said the figure “is worrying for families”.

“We left Labour with inflation bang on target, but Labour’s economic mismanagement is pushing up the cost of living for families,” he added.

Paul Dales, chief UK economist at Capital Economics, said: “These figures will make the Bank more alert to the possibility that this rebound in inflation will be bigger and last longer than it had been thinking.”

One of the Bank’s key tasks is to keep inflation at 2% and it cuts or raises interest rates to achieve that.

‘Supermarket shop is getting more and more expensive’

Tracy McGuigan-Haigh, 47, lives with her 11-year-old daughter Ruby in Dewsbury and works in retail.

She has to fit her working hours around looking after Ruby and receives universal credit on top of her wage. She says her monthly income isn’t stretching far enough.

“Even on a budget, the supermarket shop is getting more and more expensive. I’m not coming out with a lot in my arms.

“Before, I’d have needed a trolley for £40 worth of food. Now it doesn’t even fill a basket – you can carry that much in your arms.”

She says the cost of everyday items is “killing” her and doesn’t believe any future fall in interest rates will make a difference.

“It’s gone too far. I’ve juggled so much that I’ve dropped balls, and somebody’s going ‘it’ll get better’. But, even if it does improve now, what’s the support for the people who are down there, who are on the floor?”

Leave a Reply